Medicare Part B Premiums 2026: 6% Increase Impact on Your Budget

The projected 6% increase in Medicare Part B Premiums for 2026 signals a crucial financial adjustment for millions of beneficiaries, necessitating proactive budget planning and understanding of contributing factors.

For millions of Americans relying on Medicare, understanding potential changes to healthcare costs is paramount. The anticipated 6% increase in Medicare Part B Premiums for 2026 is a significant development that could impact your financial planning and overall budget. This projected rise warrants a closer look at what drives such adjustments and how beneficiaries can prepare.

Understanding Medicare Part B and Its Premiums

Medicare Part B covers medically necessary services like doctor visits, outpatient care, and preventive services. It’s a critical component of healthcare for seniors and certain younger individuals with disabilities. Unlike Part A, which is often premium-free for those who’ve paid Medicare taxes through employment, Part B typically involves a monthly premium.

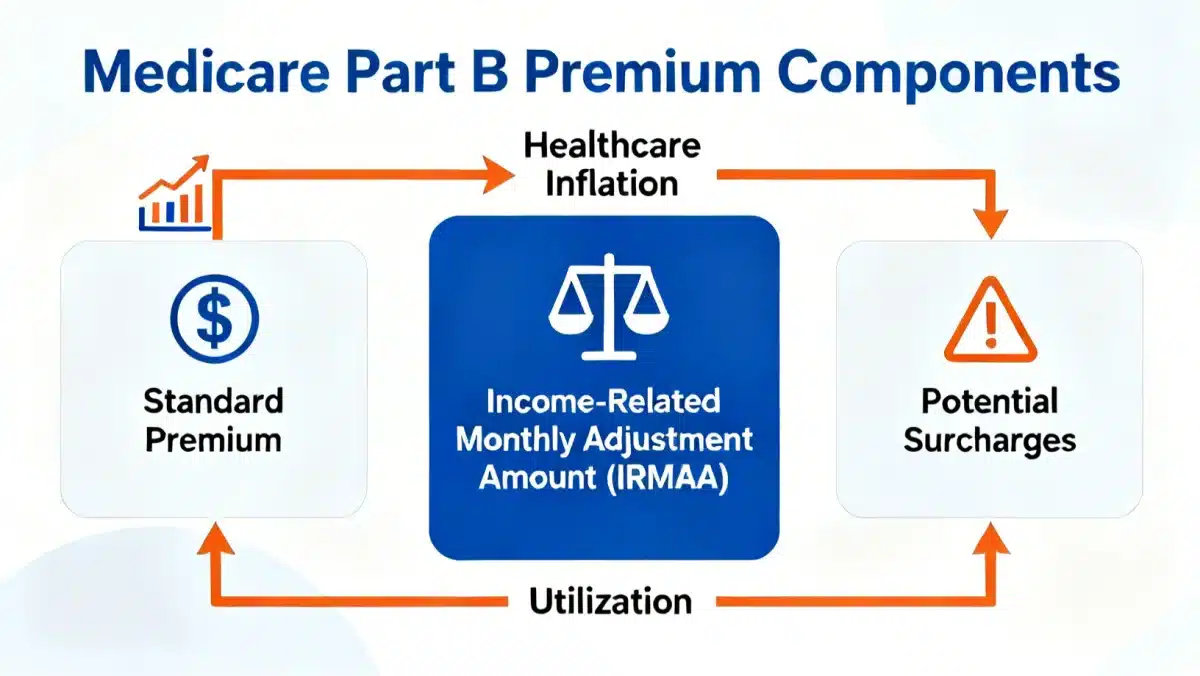

These premiums are set annually by the Centers for Medicare & Medicaid Services (CMS) and are influenced by several economic and healthcare-specific factors. The standard premium is the baseline, but many beneficiaries, particularly those with higher incomes, pay more due to the Income-Related Monthly Adjustment Amount (IRMAA). Understanding these foundational elements is the first step in comprehending the impact of any future increases.

The Role of Healthcare Costs in Premium Adjustments

Healthcare costs are a ceaseless driver of premium changes. Factors such as new medical technologies, pharmaceutical advancements, and the overall utilization of medical services directly influence the expenditures of the Medicare program. When these costs rise, it often translates into higher premiums for beneficiaries.

- Increased Utilization: More doctor visits, diagnostic tests, and treatments can strain the system’s finances.

- Prescription Drug Costs: While Part D covers most prescription drugs, their overall impact on the healthcare ecosystem can indirectly affect Part B.

- Technological Advancements: New medical devices and procedures, though beneficial, often come with higher price tags.

The continuous evolution of medical science, while improving health outcomes, also presents a financial challenge. CMS must balance providing access to cutting-edge care with maintaining the solvency of the Medicare trust funds, a balance often reflected in premium adjustments.

Ultimately, the premiums are designed to cover approximately 25% of the program’s costs, with general tax revenues covering the remaining 75%. This structure means that even small shifts in overall program expenditures can lead to noticeable changes in individual premiums, making the projected 6% increase for 2026 a direct consequence of these broader financial dynamics.

Analyzing the Projected 6% Increase for 2026

A projected 6% increase in Medicare Part B Premiums for 2026 represents a substantial jump for beneficiaries, potentially adding a significant amount to monthly healthcare expenses. This projection is not merely an arbitrary figure but is typically based on detailed actuarial analyses and economic forecasts.

Several key factors likely contribute to this anticipated rise. Economic inflation, particularly within the healthcare sector, plays a crucial role. When the cost of medical services, supplies, and administrative overhead increases, the program’s expenses follow suit, necessitating higher premiums to maintain funding levels.

Economic Factors Driving the Increase

Beyond general inflation, specific economic pressures within the healthcare industry are major contributors. These include rising labor costs for healthcare professionals, increased demand for services due to an aging population, and the ongoing expense of managing chronic conditions.

- Healthcare Inflation: The cost of medical goods and services often outpaces general inflation.

- Aging Population: A growing number of beneficiaries means increased demand on the system.

- Provider Payment Updates: Adjustments to how Medicare pays doctors and hospitals can also impact premium calculations.

Furthermore, the financial stability of the Medicare trust funds is constantly monitored. If projections indicate a shortfall, premium increases may be implemented to shore up reserves and ensure the program’s long-term viability. This proactive approach aims to prevent more drastic measures down the line, but it places a direct burden on current beneficiaries.

The 6% projection suggests that actuaries foresee a period of elevated healthcare spending or a need to bolster the program’s financial standing. Understanding these underlying economic currents is essential for beneficiaries to grasp why such increases are deemed necessary and to anticipate their personal financial implications.

Impact on Your Budget: What to Expect

A 6% hike in Medicare Part B Premiums for 2026 will undoubtedly affect the budgets of millions of Americans. For those on fixed incomes, even a seemingly modest percentage increase can translate into a tangible reduction in disposable income. The standard monthly premium, along with any applicable Income-Related Monthly Adjustment Amounts (IRMAA), will see an upward revision.

This means less money available for other essential expenses such as groceries, housing, transportation, and discretionary spending. It’s not just the premium itself; higher premiums can also indirectly influence other healthcare-related costs if they are tied to Part B, though this is less common.

Calculating Your Potential New Premium

While the exact dollar amount won’t be finalized until closer to 2026, beneficiaries can estimate the impact. If the current standard Part B premium is, for example, $174.70 (a hypothetical figure for illustration), a 6% increase would add approximately $10.48, bringing the new premium to around $185.18. For individuals subject to IRMAA, the increase will be proportionally higher, as the IRMAA is added on top of the standard premium.

Consider the cumulative effect over a year: an additional $10.48 per month becomes an extra $125.76 annually. For couples, this doubles to over $250. These figures, while illustrative, highlight the need for careful financial planning.

Beneficiaries should review their current financial situation and project how this increase will fit into their overall budget. It may necessitate re-evaluating other expenditures or exploring options to offset the higher cost. The impact is particularly pronounced for those whose income is just above an IRMAA threshold, as a small increase in income could push them into a higher premium bracket, exacerbating the 6% rise.

Preparing for this change involves more than just acknowledging it; it requires active financial forecasting and potentially adjusting spending habits or savings strategies to accommodate the new reality of Medicare costs. The goal is to minimize the shock and maintain financial stability despite rising healthcare expenses.

Strategies to Mitigate Rising Costs

Facing a projected 6% increase in Medicare Part B Premiums for 2026 requires proactive financial planning. Fortunately, several strategies can help beneficiaries mitigate the impact of rising costs and manage their healthcare budget more effectively. These approaches range from reviewing existing coverage to exploring financial assistance programs.

One primary strategy involves a thorough review of your current Medicare coverage. Are you utilizing all the preventive services covered by Part B? Are there any gaps in your coverage that could lead to unexpected out-of-pocket expenses? Understanding your benefits can help you maximize their value and potentially reduce other costs.

Reviewing Your Medicare Advantage Plan (if applicable)

If you are enrolled in a Medicare Advantage (Part C) plan, it’s crucial to remember that these plans typically include Part A and Part B benefits, often with additional perks like vision, dental, and hearing coverage. While your Part B premium still applies, some Advantage plans may offer reductions or rebates on your Part B premium, though this is less common with significant premium hikes.

- Annual Enrollment Period: Use the Annual Enrollment Period (AEP) to compare plans.

- Premium Reductions: Some plans may offer partial or full Part B premium rebates.

- Cost-Sharing: Evaluate deductibles, co-pays, and out-of-pocket maximums to ensure they align with your budget.

It’s vital to assess if your current Advantage plan remains the best fit for your health needs and financial situation. A different plan might offer lower overall out-of-pocket costs, even with a higher Part B premium. Compare benefits, provider networks, and drug formularies carefully.

Another critical area is exploring financial assistance programs. State-specific Medicare Savings Programs (MSPs) can help low-income beneficiaries pay for Part B premiums, deductibles, co-insurance, and co-payments. These programs have income and resource limits, but they can provide significant relief. Additionally, pharmaceutical assistance programs or patient assistance programs offered by drug manufacturers can help with medication costs, indirectly freeing up funds to cover higher Part B premiums.

Finally, maintaining good health through preventive care can indirectly save money by reducing the need for costly medical interventions. Regular check-ups, vaccinations, and adherence to treatment plans are investments in your long-term health and financial well-being.

The Role of IRMAA in 2026 Premiums

The Income-Related Monthly Adjustment Amount (IRMAA) plays a significant role in determining what many higher-income beneficiaries pay for Medicare Part B Premiums for 2026. IRMAA is an additional amount you pay on top of your standard Part B premium if your modified adjusted gross income (MAGI) exceeds certain thresholds. These thresholds are adjusted annually, but the impact of a 6% increase in the standard premium will be magnified for those subject to IRMAA.

When the standard Part B premium increases, the IRMAA surcharges, which are calculated as percentages of that standard premium, also increase. This means beneficiaries in higher income brackets will see a proportionally larger dollar increase in their total Part B premium compared to those paying only the standard amount.

Understanding IRMAA Thresholds and Tiers

IRMAA is structured into several income tiers, with each tier corresponding to a different percentage surcharge. Your MAGI from two years prior is generally used to determine your IRMAA. For example, your 2024 income would typically determine your 2026 IRMAA. It’s crucial to be aware of these thresholds to anticipate your premium liability.

- Income Review: Medicare uses your tax return from two years prior.

- Tiered Structure: Higher MAGI results in higher IRMAA surcharges.

- Life-Changing Events: Certain events like marriage, divorce, or retirement can lead to a reduction in IRMAA through an appeal.

If you’ve experienced a life-changing event that significantly reduced your income, you may be able to appeal your IRMAA determination. This appeal process involves contacting the Social Security Administration (SSA) and providing documentation of the event and your reduced income. Successfully appealing can lead to a lower IRMAA, thereby mitigating the impact of the 6% premium increase.

Planning for IRMAA involves careful consideration of your income streams, especially in retirement. Strategies like managing capital gains, timing Roth conversions, or utilizing qualified charitable distributions (QCDs) from IRAs can help keep your MAGI below IRMAA thresholds. Understanding how these factors interact with the projected 6% increase is vital for effective financial management in the years leading up to and including 2026.

The Broader Economic Landscape and Medicare

The projected 6% increase in Medicare Part B Premiums for 2026 cannot be viewed in isolation; it is deeply intertwined with the broader economic landscape of the United States. Factors such as national inflation rates, economic growth, and federal budget priorities all play a significant role in shaping Medicare’s financial health and, consequently, its premiums.

High inflation across the economy, particularly in sectors like healthcare, directly translates into increased costs for the Medicare program. When the cost of everything from medical supplies to labor rises, Medicare’s expenditures grow, which must be offset either through premiums or general tax revenues. A robust economy, conversely, might generate more tax revenue, potentially easing the pressure on premiums, but this is not always a direct correlation.

Federal Budget and Legislative Influences

Decisions made in Congress regarding the federal budget and healthcare legislation can also profoundly influence Medicare premiums. Changes to how Medicare is funded, adjustments to provider payment rates, or new mandates for covered services can all impact the program’s financial outlook.

- Congressional Actions: Legislative changes can directly affect Medicare funding.

- Economic Indicators: Broader economic trends influence healthcare costs and revenue.

- Long-Term Projections: Actuarial reports on Medicare’s solvency guide future premium adjustments.

Furthermore, the aging of the baby boomer generation continues to place increasing demand on the Medicare system. As more individuals enroll and utilize services, the overall cost of the program rises. This demographic shift is a long-term factor that consistently pressures premiums upwards, making sustainable funding a perpetual challenge.

Understanding these broader economic and legislative forces provides context for why premium increases like the projected 6% for 2026 occur. It underscores the complex interplay between national finances, healthcare policy, and individual beneficiary costs. Staying informed about these macro-level trends can help beneficiaries better anticipate and plan for future changes to their Medicare expenses.

Preparing for Future Medicare Premium Changes

Given the consistent upward trend in healthcare costs, beneficiaries should always anticipate future adjustments to their Medicare Part B Premiums for 2026 and beyond. Proactive preparation is key to maintaining financial stability and ensuring uninterrupted access to necessary medical care. This involves a combination of financial planning, staying informed, and exploring all available resources.

One fundamental aspect of preparation is regular financial review. Assess your income, expenses, and savings at least annually. This allows you to identify potential shortfalls or areas where you can adjust spending to accommodate increased healthcare costs. Consider creating a dedicated healthcare savings fund to cover deductibles, co-pays, and premium increases.

Financial Planning and Savings Strategies

Long-term financial planning is crucial for managing Medicare costs. This includes decisions made years before retirement, such as contributing to health savings accounts (HSAs) if eligible, which offer tax advantages for healthcare expenses in retirement. For those already retired, managing income to minimize IRMAA is a vital strategy.

- Health Savings Accounts (HSAs): Maximize contributions for tax-free growth and withdrawals for medical expenses.

- Income Management: Strategically manage retirement income to stay below IRMAA thresholds.

- Emergency Fund: Maintain a robust emergency fund to cover unexpected medical costs or premium spikes.

Staying informed about Medicare policy changes and economic forecasts is equally important. Pay attention to announcements from the Centers for Medicare & Medicaid Services (CMS) and the Social Security Administration (SSA). Subscribing to official newsletters or reputable financial news sources focusing on retirement and healthcare can provide timely updates.

Finally, don’t hesitate to seek professional financial advice. A financial planner specializing in retirement planning can help you integrate Medicare costs into your overall financial strategy, explore options like long-term care insurance, and advise on income management techniques to minimize premium liabilities. Preparing for future Medicare premium changes is an ongoing process that requires diligence and adaptability.

| Key Aspect | Brief Description |

|---|---|

| Projected Increase | Medicare Part B premiums are projected to increase by 6% in 2026. |

| Driving Factors | Healthcare inflation, increased utilization, and program solvency needs. |

| Budget Impact | Higher monthly costs, especially for those with IRMAA; necessitates budget adjustments. |

| Mitigation Strategies | Reviewing plans, financial assistance, and income management. |

Frequently Asked Questions About Medicare Part B Premiums

Medicare Part B is medical insurance that covers medically necessary services, such as doctor visits, outpatient care, preventive services, and some home health care. It’s an essential part of original Medicare, helping beneficiaries access crucial medical treatments and diagnostic tests to maintain their health.

The projected 6% increase for 2026 is largely driven by rising healthcare costs due to inflation, increased utilization of medical services by an aging population, and the ongoing need to ensure the Medicare program’s financial stability. These factors contribute to higher overall program expenditures.

A 6% increase will mean a higher monthly premium, reducing your disposable income. For example, if the standard premium is $174.70, it could rise by about $10.48 per month. Those subject to IRMAA will see an even larger dollar increase, necessitating budget adjustments.

IRMAA, or Income-Related Monthly Adjustment Amount, is an additional charge added to your Part B premium if your income exceeds certain thresholds. It means higher-income beneficiaries pay a larger share of their healthcare costs. The 6% increase will apply to the standard premium, making IRMAA surcharges also higher.

Yes, strategies include reviewing Medicare Advantage plans for potential premium rebates, exploring Medicare Savings Programs for financial assistance, and managing your income to avoid or reduce IRMAA. Proactive financial planning and staying informed are crucial for mitigating these costs.

Conclusion

The projected 6% increase in Medicare Part B Premiums for 2026 underscores the dynamic nature of healthcare costs and the importance of continuous financial vigilance for beneficiaries. While such increases can present budgetary challenges, understanding the underlying factors and implementing proactive strategies can help mitigate their impact. By staying informed, reviewing coverage options, and exploring financial assistance, individuals can better prepare for these adjustments and maintain stability in their healthcare spending. Planning ahead is not just about reacting to changes but about strategically positioning oneself for long-term financial health within the evolving Medicare landscape.